To find your variable costs per unit, start by finding your total cost of goods sold in a month. If you have any other costs tied to the products you sell—like payments to a contractor to complete a job—add them to your cost of goods sold to find your total variable costs. Break-even analysis helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps determine the minimum price movements required to cover trading costs and make a profit.

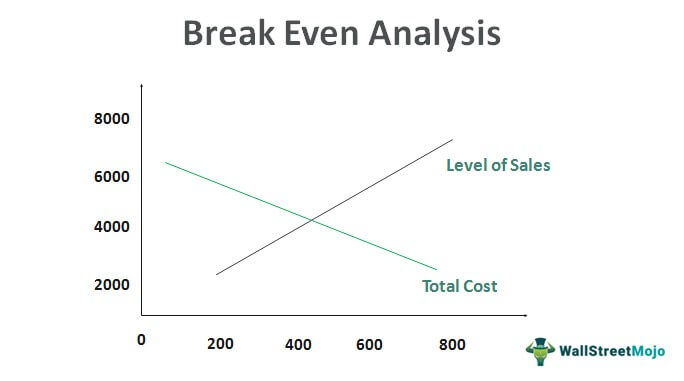

Using break-even analysis to determine level of production

Thus, the following are some of the differences between the two concepts but both are widely used in the financial market. The break-even situation for the given case can be calculated in either quantity terms or in dollar terms. Our online calculators, converters, randomizers, and content are provided “as is”, free of charge, and without any warranty or guarantee. Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors. We are not to be held responsible for any resulting damages from proper or improper use of the service. Market changes (outside of your control) fluctuate all the time, and they can influence your metrics.

Assumes constant selling prices

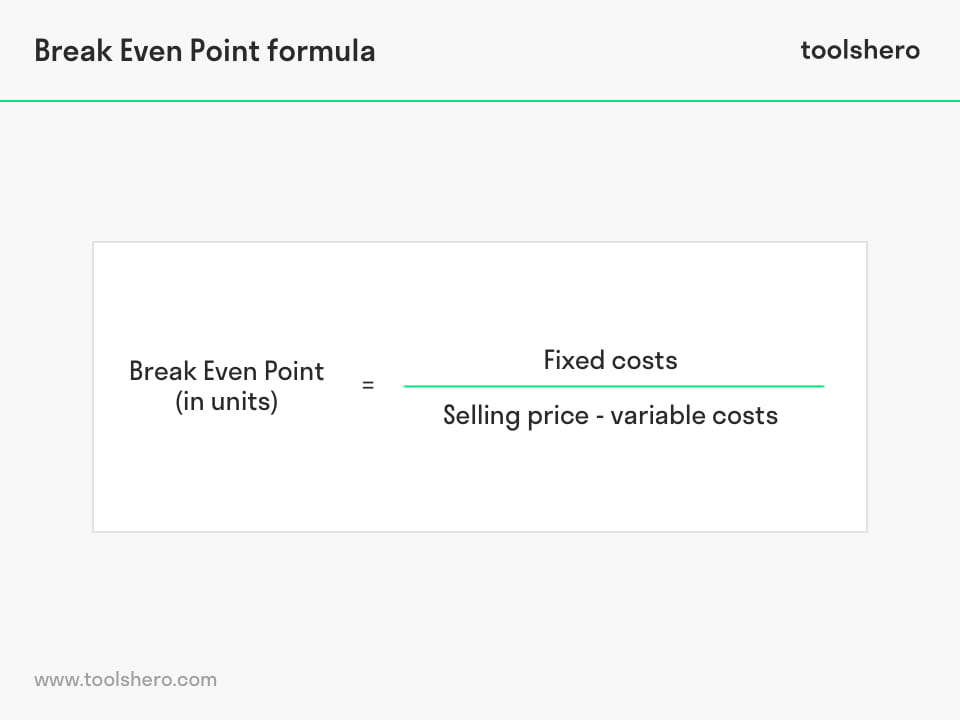

In the first approach, we have to divide the fixed cost by contribution per unit i.e. This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates. taking your accounts payable paperless We use the formulas for number of units, revenue, margin, and markup in our break-even calculator which conveniently computes them for you. It’s all about understanding when your sales will finally cover total costs.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Typically, an increase in product manufacturing volumes translates to a decrease in break-even prices because costs are spread over more product quantity.

- Break-even analysis can also be a great way to measure and benchmark your business’s performance over time.

- Here we are solving for the price given a known fixed and variable cost, as well as an estimated number of units sold.

Why Should Taxes and Fees Be Included in a Break-Even Analysis?

In this case, you estimate how many units you need to sell, before you can start having actual profit. The fixed costs are a total of all FC, whereas the price and variable costs are measured per unit. This break-even calculator allows you to perform a task crucial to any entrepreneurial endeavor.

Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly. Examples of fixed costs for a business are monthly utility expenses and rent. In the second approach of break even analysis method, we have to divide the fixed cost by contribution to sales ratio or profit-volume ratio i.e. Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The Break-Even Point (BEP) is the inflection point at which the revenue output of a company is equal to its total costs and starts to generate a profit.

This section provides an overview of the methods that can be applied to calculate the break-even point. It is possible to calculate the break-even point for an entire organization or for the specific projects, initiatives, or activities that an organization undertakes. To learn more about stocks and how to begin investing, check out The Motley Fool’s Broker Center.

The break-even point is crucial for businesses to ensure that they are not operating at a loss. It helps you understand how much money you need to make before you start generating profits, allowing for more effective financial planning. When it comes to securing investors, especially starting out, they want to see that you’ve done your homework and understand how your business will make money. It shows potential investors how much you need to sell to cover your costs and when they can expect to see returns on their investment. When calculating break-even quantities, it is important to account for taxes, which are a real expense that a company incurs. Taxes do not vary directly with the revenues; instead they are usually calculated on taxable profits.

A break-even analysis allows you to determine your break-even point. Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. Now it is very easy to calculate the breakeven and to use the formula defined at the beginning of the break-even analysis case study.

If a company has reached its break-even point, the company is operating at neither a net loss nor a net gain (i.e. “broken even”). There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

The profit is $190 minus the $175 breakeven price, or $15 per share. The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take.

A break-even price is the amount of money, or change in value, for which an asset must be sold to cover the costs of acquiring and owning it. It can also refer to the amount of money for which a product or service must be sold to cover the costs of manufacturing or providing it. If you won’t be able to reach the break-even point based on your current price, you may want to increase it. Increasing the sales price of your items may seem like an impossible task. Ideally, you should conduct this financial analysis before you start a business so you have a good idea of the risk involved. Existing businesses should conduct this analysis before launching a new product or service to determine whether or not the potential profit is worth the startup costs.